Cyber perils are the biggest concern for companies globally in 2022, according to the Allianz Risk Barometer.

The threat of ransomware attacks, data breaches or major IT outages worries companies even more than business and supply chain disruption, natural disasters or the COVID-19 pandemic, all of which have heavily affected firms in the past year.

Cyber incidents tops the Allianz Risk Barometer for only the second time in the survey’s history (44% of responses), Business interruption drops to a close second (42%) and Natural catastrophes ranks third (25%), up from sixth in 2021. Climate change climbs to its highest-ever ranking of sixth (17%, up from ninth), while Pandemic outbreak drops to fourth (22%). The annual survey from Allianz Global Corporate & Specialty (AGCS) incorporates the views of 2,650 experts in 89 countries and territories, including CEOs, risk managers, brokers and insurance experts. View the full global and country risk rankings.

“‘Business interrupted’ will likely remain the key underlying risk theme in 2022,” AGCS CEO Joachim Mueller summarizes. “For most companies the biggest fear is not being able to produce their products or deliver their services. 2021 saw unprecedented levels of disruption, caused by various triggers. Crippling cyber-attacks, the supply chain impact from many climate change-related weather events, as well as pandemic-related manufacturing problems and transport bottlenecks wreaked havoc. This year only promises a gradual easing of the situation, although further COVID-19-related problems cannot be ruled out. Building resilience against the many causes of business interruption is increasingly becoming a competitive advantage for companies.”

Business interruption (BI) ranks as the second most concerning risk. In a year marked by widespread disruption, the extent of vulnerabilities in modern supply chains and production networks is more obvious than ever. According to the survey, the most feared cause of BI is cyber incidents; reflecting the rise in ransomware attacks but also the impact of companies’ growing reliance on digitalization and the shift to remote working. Natural catastrophes and pandemic are the two other important triggers for BI in the view of respondents.

In the past year post-lockdown surges in demand have combined with disruption to production and logistics, as COVID-19 outbreaks in Asia closed factories and caused record congestion levels in container shipping ports. Other knock-on effects included a spike in demand for energy, which led to power blackouts and further factory closures in Asia, as well as acute shortages of labor in the transport, hospitality, and food production sectors. Pandemic-related delays compounded other supply chain issues, such as the Suez Canal blockage or the global shortage of semiconductors after plant closures in Taiwan, Japan and Texas from weather events and fires.

“The pandemic has exposed the extent of interconnectivity in modern supply chains and how multiple unrelated events can come together to create widespread disruption. For the first time the resilience of supply chains has been tested to breaking point on a global scale,” says Philip Beblo, Property Industry Lead, Technology, Media and Telecoms, at AGCS.

According to the recent Euler Hermes Global Trade Report, the COVID-19 pandemic will likely drive high levels of supply chain disruption into the second half of 2022, although mismatches in global demand and supply and container shipping capacity are eventually predicted to ease, assuming no further unexpected developments.

Awareness of BI risks is becoming an important strategic issue across entire companies. “There is a growing willingness among top management to bring more transparency to supply chains with organizations investing in tools and working with data to better understand the risks and create inventories, redundancies and contingency plans for business continuity,” says Maarten van der Zwaag, Global Head of Property Risk Consulting at AGCS.

Making businesses more weatherproof

Pandemic outbreak remains a major concern for companies but drops from second to fourth position (although the survey predated the emergence of the Omicron variant). While the COVID-19 crisis continues to overshadow the economic outlook in many industries, encouragingly, businesses do feel they have adapted well. The majority of respondents (80%) think they are adequately or well-prepared for a future incident. Improving business continuity management is the main action companies are taking to make them more resilient.

The rise of Natural catastrophes and Climate change to third and sixth position respectively is telling, with both upwards trends closely related. Recent years have shown the frequency and severity of weather events are increasing due to global warming.

For 2021, global insured catastrophe losses were well in excess of $100bn – the fourth highest year on record. Hurricane Ida in the US may have been the costliest event, but more than half of the losses came from so-called secondary perils such as floods, heavy rain, thunderstorms, tornados and even winter freezes, which can often be local but increasingly costly events.

Examples included Winter Storm Uri in Texas, the low-pressure weather system Bernd, which triggered catastrophic flooding in Germany and Benelux countries, the heavy flooding in Zhengzhou, China, and heatwaves and bushfires in Canada and California.

Allianz Risk Barometer respondents are most concerned about climate-change related weather events causing damage to corporate property (57%), followed by BI and supply chain impact (41%). However, they are also worried about managing the transition of their businesses to a low-carbon economy (36%), fulfilling complex regulation and reporting requirements and avoiding potential litigation risks for not adequately taking action to address climate change (34%).

“The pressure on businesses to act on climate change has increased noticeably over the past year, with a growing focus on net-zero contributions,” observes Line Hestvik, Chief Sustainability Officer at Allianz SE. “There is a clear trend for companies towards reducing greenhouse gas emissions in operations or exploring business opportunities for climate-friendly technologies and sustainable products. In the coming years, many corporate decision-makers will be looking even more closely at the impact of climate risks in their value chain and taking appropriate precautions. Many companies are building up dedicated competencies around climate risk mitigation, bringing together both risk management and sustainability experts.”

Businesses also have to become more weatherproof against extreme events such as hurricanes or flooding. “Previous once-in-a-century-events may well occur more frequently in future and also in regions which were considered ‘safe’ in the past. Both buildings and business continuity planning need to become more robust in response,” says van der Zwaag.

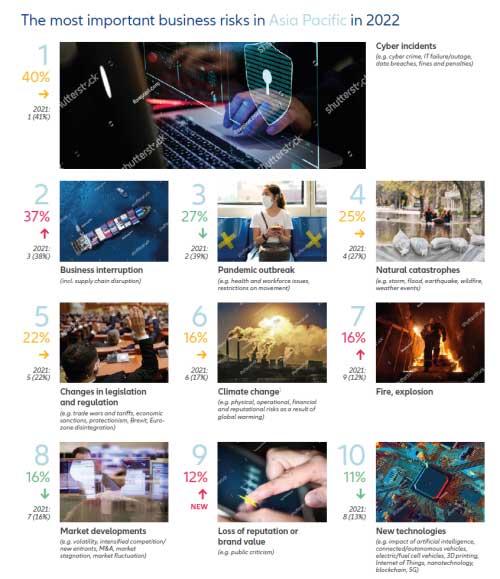

Top Asia Pacific Risks

Cyber incidents (#1 with 40% responses), is the top Asia Pacific risk for the third consecutive year while Business interruption (#2 with 37%) and Pandemic outbreak (#3 with 27%) make up the top three business risks followed by Natural catastrophes (#4 with 25% ) rounding out the key issues in the region.

In Asia Pacific, Cyber was the top risk in Australia, India and Japan reflecting the recent technology woes of companies in the region In July, Japanese companies were targeted by a cyber hacking group called APT40. IT vulnerabilities was also an issue as seen with DBS, Southeast Asia’s largest lender. Their digital banking services experienced a two-day disruption caused by an issue with its access control servers. Last month, hackers also launched over a million attacks on companies globally, including across Asia Pacific in just four days, through a previously unnoticed vulnerability in a widely-used piece of open-source software called Log4J.

As expected, Changes in legislation and regulation (#5 with 22%) also kept its place amongst the top five Asia Pacific risks in 2022 for the fourth consecutive year. In China, there is continuing crackdown on big internet companies and the US-China geopolitical rivalry has had widespread pressure on economic activity, ranging from trade to technology and investment. 2022 may likely see further political challenges, as the US heads into mid-term elections and China gathers for an all-important Communist Party Congress.

Commenting on the Asia Pacific results Mark Mitchell, AGCS APAC Managing Director, said: “It is no surprise that Cyber remains as the top Asia Pacific risk for the third consecutive year in light of the high-profile ransomware attacks, combined with challenges caused by accelerating digitalization and remote working.

Following a year of unprecedented global supply chain disruption, business interruption is a consequence of many of the other risks in the rankings, such as cyber and natural catastrophes and will be a perennial concern for companies the world over and in Asia Pacific. Meanwhile, the pandemic has exposed the extent of vulnerabilities in modern supply chains, and how multiple risks can come together to create disruption. There will be a greater need for companies to build resilience to cope with the interconnectivity of risks in future.”