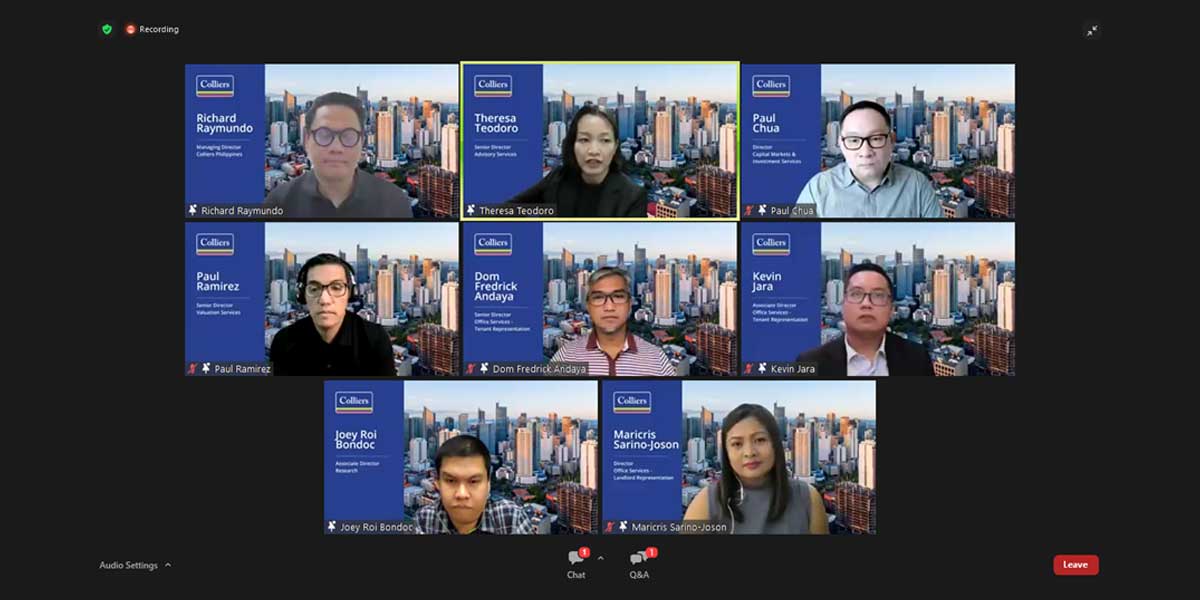

(Screenshot by Marjune N. Muzones)

By Marjune N. Muzones

Leading real estate company Colliers Philippines convened a panel of experts during its Q2 2022 Philippine Property Market Briefing, July 18, 2022, via Zoom.

Industry scholars laid out the how the Office and Residential sectors performed during the second quarter of 2022, and the Industrial and Hotel sectors on the first half of this year.

A positive net take-up of office spaces was seen after seven consecutive quarters of negative growth, mostly due to the pandemic. But it remains to be seen if growth will be maintained due to other economic shocks.

“After the first two quarters, we have a total of 325,000 sqm of office space transactions just in the first six months. This is already nearing the full-year performance of 2020. So, this may be the signal of the start of the recovery in the market,” said Kevin Jara, Associate Director-Office Services-Tenant Representation.

Jara also added that while office rentals declined by 6%, recovery will be felt by next year starting with the central business districts while office space transactions in the provinces comprise 20% of the total by having 82,000 sqm, with Davao and Cebu cities leading the pack.

“Overall, the Philippines is open for business. We are looking forward to the continued impact to the office space demand of the past legislation from the previous administration. We like the increase of FDIs in the country, coupled with the strengthening of the Dollar to support office demand especially in the BPO sector,” he stated.

The Residential sector continuous to show signs of recovery with expected decline in vacancy rates and boosted supply due to the ongoing return to normalcy.

“In terms of supply, we are seeing sustained recovery in the condominium completion across Metro Manila, 2022 up to 2023. But because of the return to office mandates, employees are now returning to traditional workspaces. They are looking for condominium units near their workplaces or they are now renting condos and some of them even buy, taking advantage of the attractive prices in the secondary markets. So, we expect vacancies to decline and that should have a positive impact on rents and the prices in secondary residential markets in Metro Manila,” Mr. Joey Roi Bondoc, Associate Director for Research said.

Bondoc also noted that the Hotel sector performed better and will continue to do so because of revenge travel and improvements in foreign tourist arrivals.

“We now see more MICE activities, more face-to-face briefings held all across the country and what we will be seeing moving forward is the opening of more foreign-branded hotels across the country, especially in Metro Manila,” he stated.

The Industrial sector meanwhile maintained relative stability on the first half of 2022 with e-commerce and manufacturing investments keeping the sector afloat.

“We have been seeing the expansion of industrial facilities in Batangas, as well as Central Luzon especially in Pampanga… There has been an increase in vacancies especially for Cavite, Laguna, as well as Batangas but we’re still optimistic that warehouse rates will improve moving forward, especially with the demand coming from e-commerce companies,” Bondoc expressed.

Recommendations were also given to consumers and developers and an open forum summed up the said webinar.

To watch the full video of the open forum, visit the Colliers Philippines YouTube page using this link: