The Philippine Institute for Development Studies (PIDS) has underscored the need for a fiscal consolidation program, complemented by an economic stimulus package focused on investments in infrastructure and social services, to reduce the country’s debt-to-GDP (gross domestic product) ratio to its pre-pandemic status and maintain manageable budget deficit levels beyond 2022.

In its study presented last week, the PIDS pointed out that, unlike in the past when public debt spiked because of interest rate shocks or fundamental issues with state enterprises or institutions, the country’s latest borrowings were the result of the pandemic-induced crisis that was preceded by a steady rise in the government’s tax effort and the implementation of tax reform.

Thus, the country’s high-debt episode is “not as deeply rooted or self-inflicted as in the past,” the PIDS said in its presentation this morning before the media.

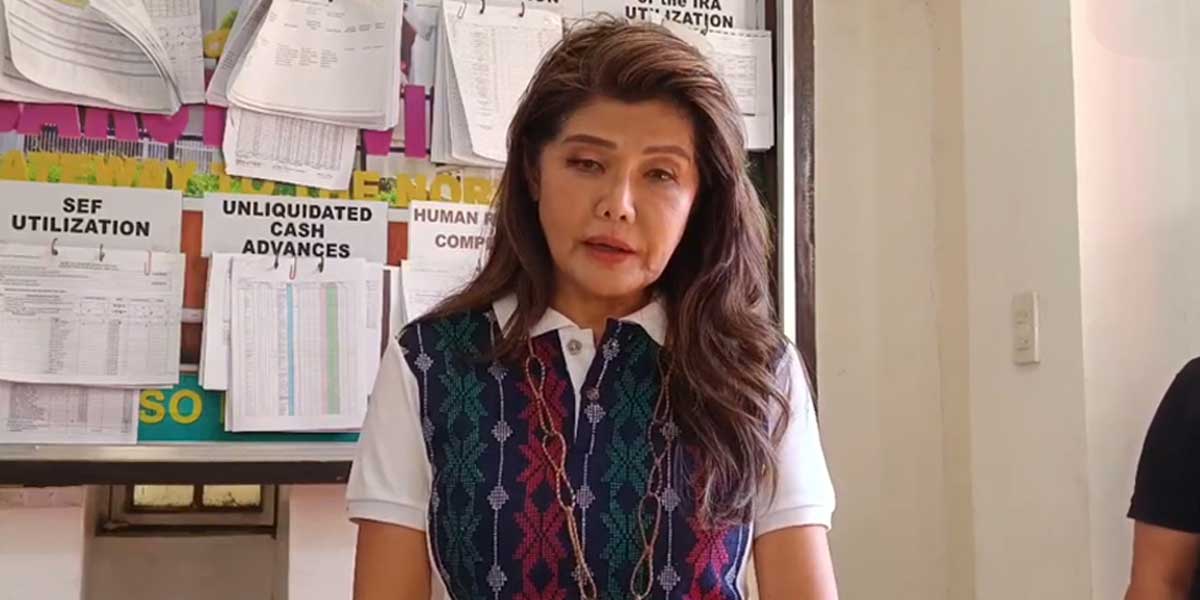

The study was presented before Finance Secretary Carlos Dominguez III, other officials of the Department of Finance (DOF), and members of the media by its authors–Margarita Debuque Gonzales, Charlotte Justine Diokno Sicat, and John Paul Corpus.

According to the study, the high debt level is “the result of a large exogenous shock to growth and revenues and of the government’s accumulation of cash reserves as a precautionary move in the event of a long-haul public health crisis.”

The PIDS study recommended that no policy reversals be done so as not to compromise debt sustainability, and that the next administration “maintain fiscal responsibility, not necessarily fiscal stringency.”

Both the national and local governments should also continue their productive spending to jumpstart the economy, it said.

“There is a need for medium- to long-term fiscal consolidation to anchor market expectations. But a fiscal stimulus is needed on items that present large multiplier effects such as infrastructure. Investments in human capital are also needed to address the risks of scarring,” said the report.

The DOF has earlier stated that fiscal consolidation is necessary to maintain spending for productive activities that could help the country recover from COVID-19.

In line with the statements of the DOF that fiscal consolidation is needed to protect the country from fiscal or economic shocks, the PIDS study also warned against fiscal risks that could undermine the country’s debt sustainability.

These risks include a possible surge in COVID-19 cases that could again lead to lockdowns and limited economic activity; natural disaster and calamities; higher contingent liabilities of social security institutions, public-private partnership (PPP) projects, underfunded pension plans of uniformed personnel which would all result in government shouldering these financial burdens; real foreign exchange shocks; interest rate shocks; and lower GDP growth associated with lower inflation and higher public spending, which leads to costly borrowings arising from higher interest rates and exchange rates.

The other risks cited by the study include the reduced fiscal space for the national government resulting from the implementation of the Supreme Court (SC) ruling that gave local government units (LGUs) a bigger share in national tax collections; geopolitical tensions such as the Russia-Ukraine conflict; lower remittances and increased number of displaced overseas Filipino workers (OFWs); decreased global credit; reduced trade; and cybersecurity glitches.

The PIDS study followed the debt sustainability analysis (DSA) framework outlined by the International Monetary Fund (IMF) to compute the country’s medium-term debt trajectory based on combined macroeconomic assumptions and forecasts of government and private sector institutions; and the fiscal gap framework of Auerbach (1994, 2020) to calculate the primary balance adjustments needed to bring the debt ratio back to pre-pandemic levels.