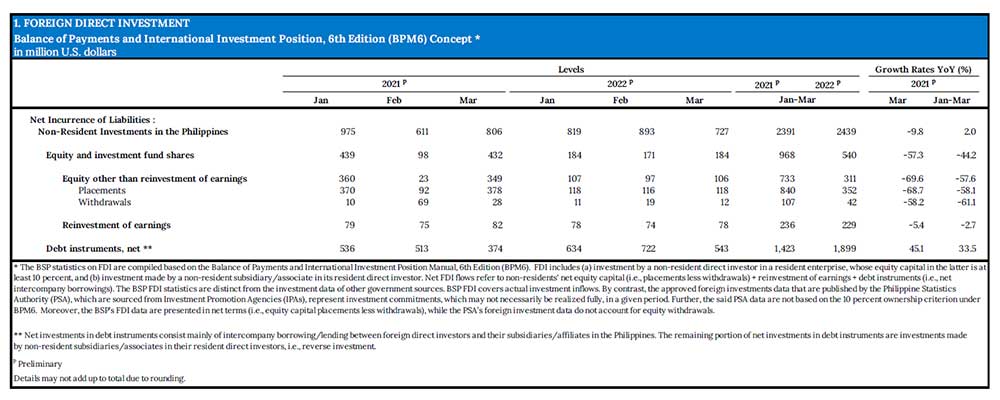

Foreign direct investment (FDI) recorded US$727 million net inflows in March 2022, albeit 9.8 percent lower than the US$806 million net inflows posted in the same period last year (Table 1).1,2

Notwithstanding, net FDI flows for the first quarter of 2022 remained positive, increasing by 2.0 percent to US$2.4 billion.

Higher net inflows from intercompany borrowing/lending between foreign direct investors and their subsidiaries continued to make up for the lower net inflows from new equity and reinvested earnings.

While the country’s macroeconomic fundamentals remain sound, external risks, such as the impact of Russia’s invasion of Ukraine on commodities and financial market condition, the start of policy tightening in several major central banks and the resurgence of COVID-19 cases in many Asian economies, may have contributed to investors’ concern about the outlook on the global economic recovery.

In particular, non-residents’ net cumulative investments in debt instruments for the first quarter of 2022 grew by 33.5 percent to US$1.9 billion from US$1.4 billion in the same period in 2021.[3]

Meanwhile, non-residents’ net investments in equity capital (other than reinvestment of earnings) and their reinvestment of earnings were lower by 57.6 percent (at US$311 million) and 2.7 percent (at US$229 million), respectively.

Specifically, equity capital placements dropped by 58.1 percent to US$352 million (from US$840 million), which was slightly offset by the 61.1 percent decline in withdrawals to US$42 million (from US$107 million).

Bulk of the equity capital placements during the period came from Japan, the United States, Kuwait, and Singapore. Said investments were channeled mainly to the 1) manufacturing; 2) real estate; and 3) financial and insurance industries.

The sustained FDI net inflows in March 2022 came largely from non-residents’ net investments in debt instruments of local affiliates, which expanded by 45.1 percent to US$543 million from US$374 million in March 2021.

Meanwhile, non-residents’ net investments in equity capital (other than reinvestment of earnings) fell by 69.6 percent to US$106 million from US$349 million in the same month last year. This resulted as equity capital placements contracted by 68.7 percent to US$118 million from US$378 million, but was somewhat mitigated by the 58.2 percent decline in equity capital withdrawals to US$12 million from US$28 million.

Equity capital placements were sourced primarily from Japan, the United States, and Singapore. These were infused largely to the 1) manufacturing; 2) real estate; and 3) financial and insurance industries. Reinvestment of earnings declined by 5.4 percent to US$78 million from US$82 million.

1 The BSP statistics on FDI are compiled based on the Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). FDI includes (a) investment by a non-resident direct investor in a resident enterprise, whose equity capital in the latter is at least 10 percent, and (b) investment made by a non-resident subsidiary/associate in its resident direct investor. FDI can be in the form of equity capital, reinvestment of earnings, and borrowings.

2 The BSP FDI statistics are distinct from the investment data of other government sources. BSP FDI covers actual investment inflows. By contrast, the approved foreign investments data that are published by the Philippine Statistics Authority (PSA), which are sourced from Investment Promotion Agencies (IPAs), represent investment commitments, which may not necessarily be realized fully, in a given period. Further, the said PSA data are not based on the 10 percent ownership criterion under BPM6. Moreover, the BSP’s FDI data are presented in net terms (i.e., equity capital placements less withdrawals), while the PSA’s foreign investment data do not account for equity withdrawals.

[3] Net investments in debt instruments consist mainly of intercompany borrowing/lending between foreign direct investors and their subsidiaries/affiliates in the Philippines. The remaining portion of net investments in debt instruments are investments made by non-resident subsidiaries/associates in their resident direct investors, i.e., reverse investment.