By Art Jimenez

(We are reprinting one of the last columns of the late Dean Arturo Jimenez who passed away on February 17, 2021. The father of COMELEC spokesperson James Jimenez, Dean Jimenez was a loyal friend of journalism and journalists, a dedicated Rotarian, and the pioneer of economic journalism in Western Visayas)

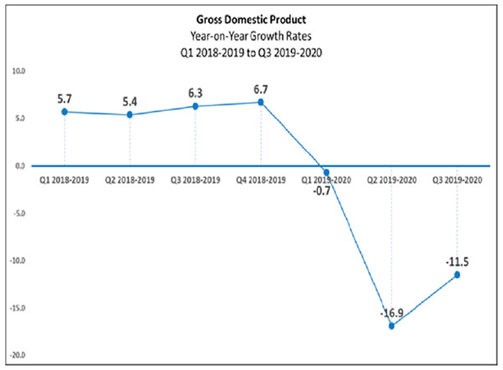

How our national economy has performed, as measured by the GDP for the last seven consecutive quarters, is best captured in the chart below.

From a rising economic growth peaking at 6.7% in the last quarter of 2019, our GDP lost that 6.7% positivity as the COVID-19 attack pulled it down at -0.7% negative growth in just three months. As the epidemic worsened into a pandemic, our economy slipped into a recession as negative GDP took its deepest dive in the next three months ending June 2020. An economy goes into recession after two successive quarters of negative growth.

By the third quarter, our health system has become better equipped and prepared to meet the invisible enemy head-on. Too, our citizenry has gotten used to the word of the year, “protocols” that staying away from infection became a daily routine, a habit. Moreover, the alternating quarantine levels and their see-saw protocols including%age-controlled opening of the economy had inured the populace. We had most likely gotten used to limited movements, which somehow became our “new normal” lives. Thus, our Q3 (Third Quarter) recession has eased somewhat to -11.5%.

Businessmen and professionals used to the stock market up-and-down flow now expect the economy to correct itself and make its rebound, not to a positive GDP growth rate (at least not yet), but at least closer to the surface of the GDP line.

This is because growing the economy is much harder than halting its slide.

Since COVID-19 hit after the 2020 national budget has been enacted into law already, the government had to scramble for amelioration funds to assist those the pandemic most direly impacted like: the de-employed due to business closures (temp or otherwise); the self-employed in the transportation industry, meaning the bus and their conductors, jeepney drivers, tricycle drivers (motorized or not), and the so-called TNVS (transport network vehicle service) like Grab.

The NG (national government) also successfully used moral suasion in persuading mall operators, apartment owners, and other types of lessors to suspend the rental payments of those affected by full or partial enterprise closures, like boutiques, spas, gyms, and restos.

Banks and utilities (such as electric companies) were also swayed to lengthen payment due dates without interest and other charges, and for them not to cut-off service.

The Bangko Sentral ng Pilipinas (BSP) did its share by reducing its reserve requirements so that banks could release hundreds of billions into the economy to provide loans to distressed companies and families still wanting to acquire their own homes.

Another service the NG has opened up for the micro, small, and medium enterprises (MSMEs) is the DTI Small Business Corporation (SBCorp) Covid-19 Assistance to Restart Enterprises (CARES) loan fund of PHP10-billion. The amount comes from the Bayanihan to Recover as One Act (R.A. No. 11494).

Of the PHP10-billion, PHP4-billion will be lent to MSMEs to pay for the 13th-month benefit of their employees. The remaining PHP6-billion is allotted to the MSMEs in the tourism sector.

MSMEs qualified for the zero-interest loans must be in operation for at least one year. Their firms should likewise have total assets of from PHP50,000 to PHP1-million. Each firm can borrow between PHP10,000 and PHP200,000, depending on its asset size.

While the loan is interest-free, it charges a “service fee of four percent (4%) for 1-year loans, six% (6%) for two-year loans, and 7.5% for three-year loans.

NOTICE that all the above NG measures are commendable and helpful. Unfortunately, they are more like band-aid solutions rather than a long-time solution to a pestering, long-term problem.

What the country needs to recover economically are long-term solutions. Finance Secretary Carlos Dominguez III and the Philippine Congress has the legislative antidote to the awful woes of Philippine business. Fond of acronyms as we Filipinos are, the twin measures that will soon become laws are known as CREATE and FIST.

What are these and will they lead us to economic recovery?

To be concluded