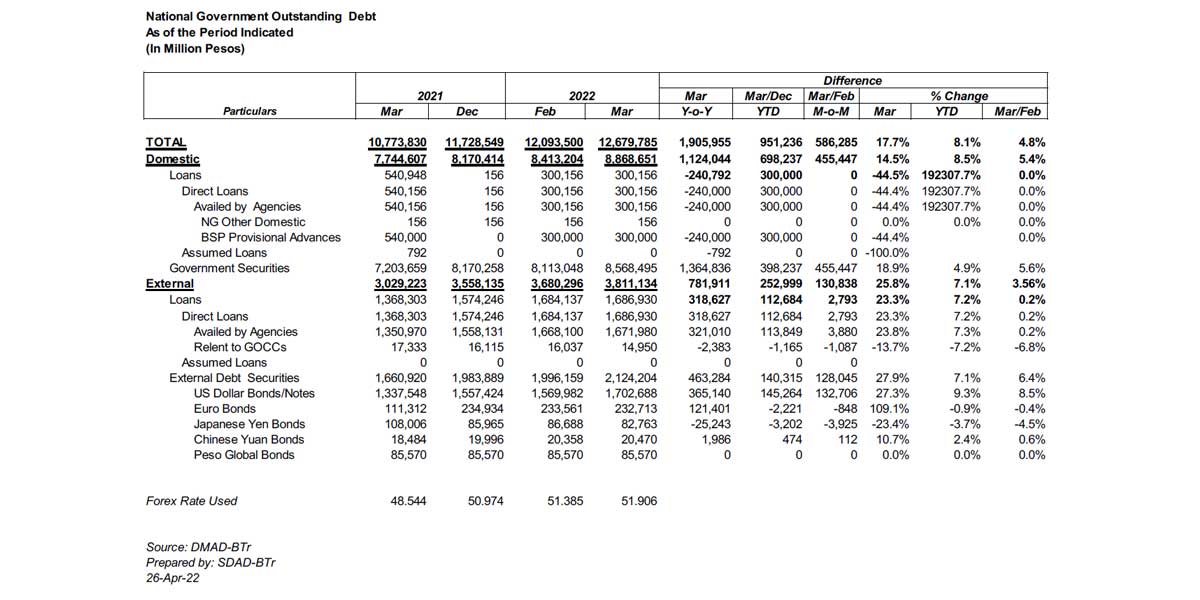

The Philippine government’s total outstanding debt was registered at P12.68 trillion as of end-March 2022.

For the month, P586.29 billion, or 4.8% of the total debt portfolio was added primarily due to the net issuance of government securities to both local and external lenders. Of the total debt stock, 30.1% was sourced externally while 69.9% were domestic borrowings.

Domestic debt amounted to P8.87 trillion, which is P455.45 billion or 5.4% higher compared to the end-February 2022 level.

For March, the national government (NG) successfully raised P457.80 billion through its domestic Retail Treasury Bond issuance and debt exchange transaction. From the end-December 2021 level, outstanding domestic debt has increased by P698.24 billion or 8.5%.

NG external debt of P3.81 trillion was P130.84 billion or 3.6% higher from the previous month.

The increment to external debt was due to the net availment of external financing amounting to P122.69 billion including the P117.33 billion (USD2.25 billion) triple tranche 5-year, 10.5-year and 25-year Global Bonds.

Meanwhile, the effect of Peso depreciation1 against the USD added P37.31 billion which was tempered by adjustments in third currencies which trimmed P29.17 billion.

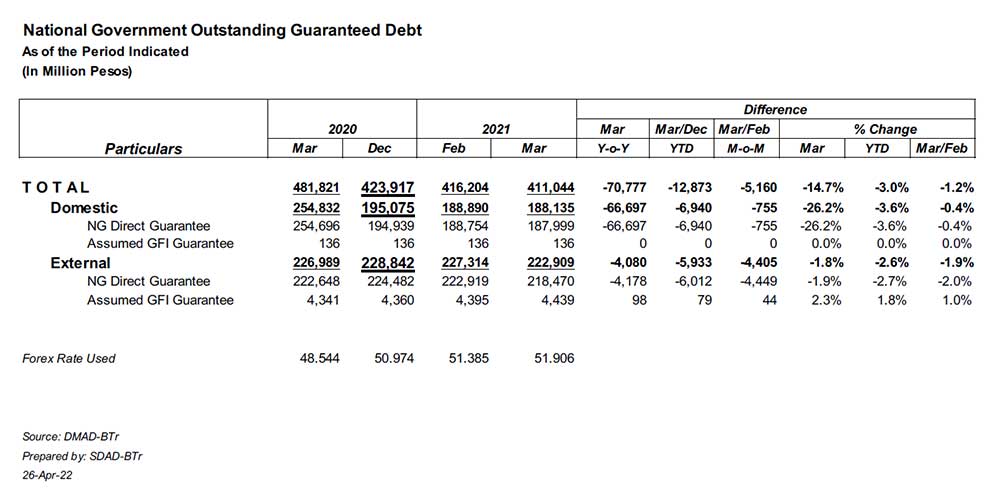

Total NG guaranteed obligations decreased by P5.16 billion or 1.2% month-over-month to P411.04 billion as of end-March 2022.

The lower level of guaranteed debt was due to the net repayment of both domestic and external guarantees amounting to P0.76 billion and P1.55 billion, respectively.

Third-currency exchange rate fluctuation further lowered the peso value of external guarantees by P5.16 billion, offsetting the P2.31 billion effect of local currency depreciation against the USD.

1The peso depreciated against the USD from P51.385 as of end-Feb 2022 to P51.906 as of end-Mar 2022.